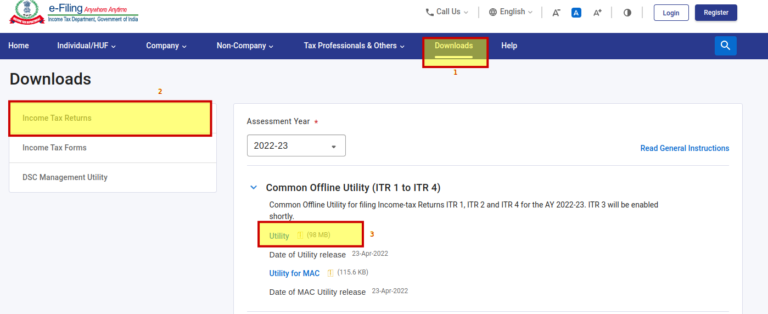

This can be done online, or by sending a signed copy of the ITR-V to the tax department.Ĭommon Mistakes to Avoid When Filing ITR 1įiling ITR 1 can be a straightforward process, but there are a few common mistakes that taxpayers should avoid. Verify the Return: Verify the return within 120 days of filing.File the Form: Submit the form online and get an acknowledgment from the tax department.Verify the Form: Verify the form and ensure that all information is correct.Fill the Form: Fill the form with the required information, such as personal details, income details, and tax paid details.Download ITR 1: Download the ITR 1 form from the income tax department’s website or income tax e-filing portal.Gather Required Documents: Keep all necessary documents such as Form 16, bank statements, and TDS certificates ready.Income Verification: The tax department can verify the taxpayer’s income and compare it with the data available with them.Faster Processing: Electronic filing of ITR 1 ensures quicker processing of the tax return.Pre-Filled Data: The form automatically fills certain data such as the name, address, PAN, and tax deducted at source (TDS) details.Electronic Filing: The form can be filed electronically, and the taxpayer does not need to submit a physical copy.Simple and Easy to Fill: ITR 1 is a one-page form that requires only basic information, making it easy to fill and file.Cannot be used by non-residents or individuals with foreign assets.Income from other sources (excluding lottery and racehorse winnings).Resident individuals who have earned income from salaries, pensions, or one house property.ITR 1 is for individuals who meet the following conditions:

0 kommentar(er)

0 kommentar(er)